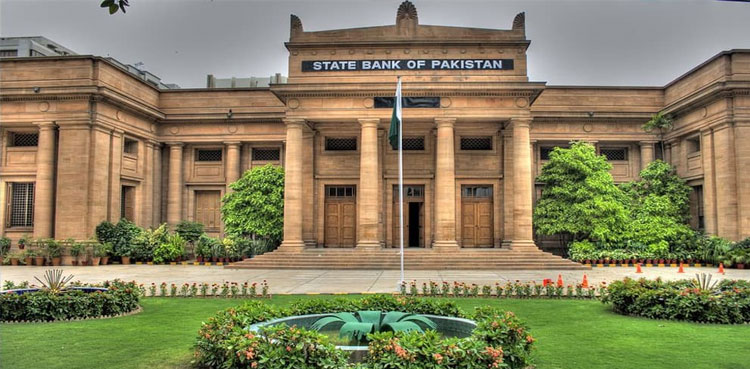

KARACHI: The State Bank of Pakistan (SBP) has announced to launch FX Matching aimed at enhancing the transparency of the foreign exchange market, ARY News reported.

According to the central bank, the FX Matching will be effective from January 29, 2024 and it will be mandatory for ADs to use FX Matching or FXT Dealing for executing Outright interbank FX transactions that impact FEEL (Foreign Exchange Exposure Limit).

A circular issued by the SBP read that FX Swap transactions concluded with the same counterparty will continue to be conducted as per current practice including FXT Dealing, telephone or other means.

“ADs can trade on FX Matching as per the timings announced for interbank FX trading by SBP from time to time. In case on any given day, Federal Reserve Bank of New York is closed and interbank FX market is open in Pakistan, the trading on the FX Matching will be in Tom value. Participants must be cautious in placing bids/offers and executing transactions on the platform and monitor their orders to avoid executing erroneous trades,” the circular read.

The trading on FX Matching will be for minimum lot size of USD 500,000 and multiples thereof. The bid or offer prices placed on the FX Matching will be firm and remain valid until cancelled by the participant quoting the prices. The participants are advised to cancel all open orders (if not executed) before logging-off from the platform and close of market for interbank FX trading.

Read More: Pakistan all set to launch online forex trading platform

Earlier on January 22, ARY News reported that Pakistan has announced the plan to launch an online trading platform for forex trading by the end of January 2024, ARY News reported.

As per details, the plan of online FX trading platform has been presented to the International Monetary Fund (IMF).

After the launch of this initiative, the trading of foreign currency in the interbank will be carried out online.

The launch of an online forex trading platform is part of Pakistan’s commitment to bring reforms in the foreign exchange market, as assured to the IMF.

Leave a Comment