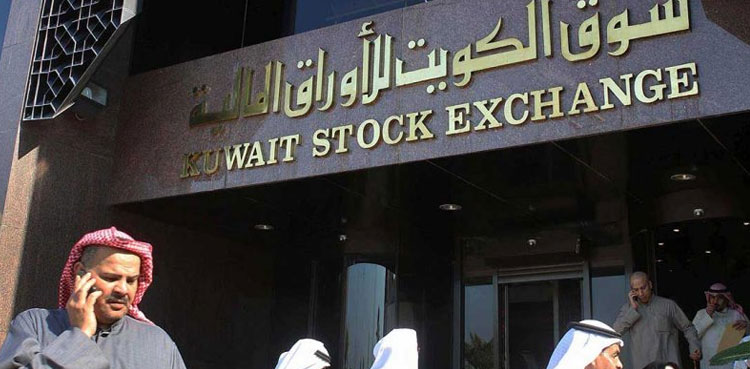

Capital Markets Authority (CMA) Kuwait, in collaboration with Boursa, unveiled a revamped regulatory framework designed to facilitate the listing and trading of emerging companies on the KSE.

Announced on Tuesday, the CMA described this development as part of its broader strategy to align with international standards, foster capital market advancement, broaden investment avenues, and enhance market competitiveness and transparency.

Central to the initiative is the goal of reinforcing investor protection.

The regulatory changes aim to strengthen listing requirements by setting clear conditions for market entry and continuity—most notably by introducing minimum thresholds for free float shares and their market valuation.

These requirements are intended to promote trading liquidity and uphold consistent regulatory compliance.

Read more: Kuwait empowers school principals to approve exit permits for Expat Teachers

The CMA asserted that fostering the growth of emerging companies is vital to supporting national economic development and corresponds with Kuwait’s long-term strategic goals.

The newly established market will serve as an accessible financing channel for smaller enterprises and an innovative investment space for market participants, all within a high-transparency framework.

The creation of this market stems from an in-depth study conducted by the CMA, which informed the design of the regulatory infrastructure governing the emerging companies platform.

The Authority sees this move as both a support mechanism for smaller businesses and a means of attracting investment in line with international best practices.

Leave a Comment