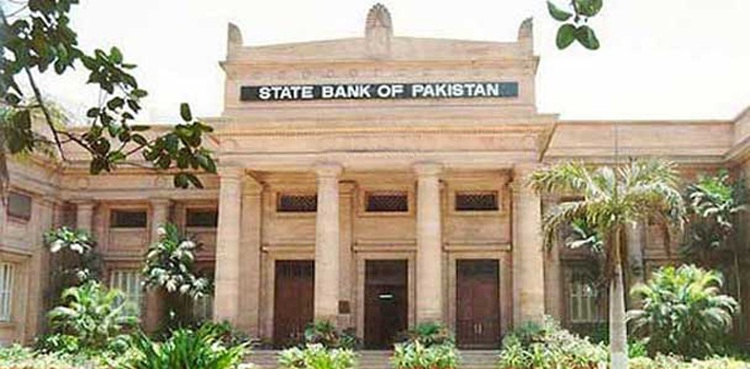

KARACHI: The State Bank of Pakistan (SBP) said on Tuesday the banking sector maintained its growth momentum during the first quarter (Jul-Sep) of the ongoing fiscal year.

The central bank in its “Quarterly Compendium: Statistics of the Banking System for Jul-Sep, 2021”, issued today, revealed that bank assets rose by 2.17 per cent during the period over last quarter (20.9 percent growth on YoY basis), surpassing 0.44 per cent growth in the corresponding period of last year.

Also Read: SBP unveils licensing and regulatory framework for digital banks

“This expansion has been particularly contributed by the domestic private sector advances, which increased by 3.8 per cent during Q3CY21 (16.6 percent increase YoY) against a contraction of 0.5 percent during the corresponding period of the last year,” the central bank said.

On funding side, it added deposits increased by 0.36 per cent during the quarter as compared to 0.80 per cent growth in same period of previous year. On a YoY basis, deposits saw an encouraging growth of 16.9 percent.

The SBP said the increase in advances remained broad based reflecting a general recovery in the economic activity as well as the impact of higher input prices. “The healthy growth in credit to the private sector is quite encouraging, as it will prop up the low credit incidence in Pakistan as measured by domestic private credit to GDP ratio,” it pointed out.

“Moreover, SBP’s refinance schemes announced in the wake of COVID-19, particularly the Temporary Economic Refinance Facility (TERF), has been supporting the private sector credit growth in the last few quarters. However, the banks have increased the credit disbursements from their own sources during Jul-Sep-2021 quarter and the trend continues post quarter.”

Also Read: SBP announces new measures to restrict dollar trade

“The earning indicators of the banking sector witnessed some moderation during Q3CY21 as the Return on Assets (ROA) stood at 0.95 percent in Q3CY21 compared to 1.13 percent in Q3CY20. The solvency of the of the sector remained strong as the Capital Adequacy Ratio (CAR) at 17.9 percent stayed well above the minimum domestic regulatory benchmark of 11.5 percent and the global standard of 10.5 percent. The quarterly stress test results also reveal that the banking sector is likely to remain resilient even under reasonably severe economic shocks over a protracted period of time.”

Leave a Comment