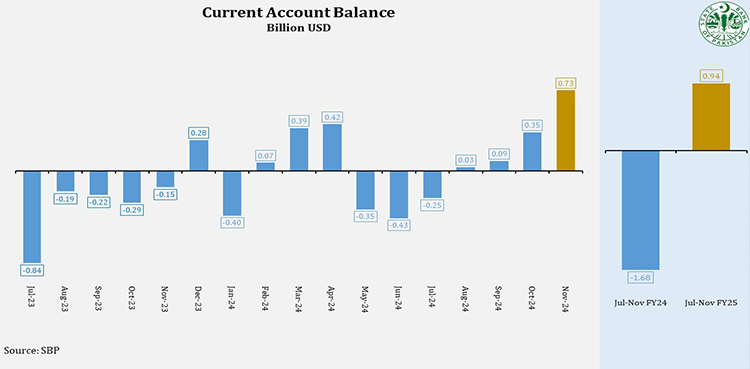

ISLAMABAD: Pakistan’s current account balance has remained in surplus for the fourth consecutive month, according to the State Bank of Pakistan, ARY News reported.

According to reports, the State Bank of Pakistan has reported a current account surplus of $729 million for November 2024, marking the highest surplus since February 2015. The surplus reflects a positive trend in the country’s economic indicators, showing an improvement in the balance of payments.

In addition to this, the trade, services, and income deficit for November amounted to $2.35 billion. For the first five months of the fiscal year, the current account surplus reached $944 million, highlighting a significant turnaround compared to previous periods.

From July to November, Pakistan’s exports totaled $13.28 billion, while imports were $22.97 billion, resulting in a trade deficit of $9.68 billion. This deficit is a 10pc increase compared to the same period last year. To manage the trade gap, the country has additional resources available, amounting to a 33pc increase compared to previous years.

Remittances from workers also contributed positively, with $14.76 billion received in the first five months of the fiscal year. Despite a slight decrease in IT exports in November, which stood at $324 million marking a 2pc drop compared to October, the overall economic outlook remains optimistic with a surplus of $729 million recorded for the month.

In addition to this, the trade, services, and income deficit for November amounted to $2.35 billion. For the first five months of the fiscal year, the current account surplus reached $944 million, highlighting a significant turnaround compared to previous periods.

From July to November, Pakistan’s exports totaled $13.28 billion, while imports were $22.97 billion, resulting in a trade deficit of $9.68 billion. This deficit is a 10% increase compared to the same period last year. To manage the trade gap, the country has additional resources available, amounting to a 33pc increase compared to previous years.

Remittances from workers also contributed positively, with $14.76 billion received in the first five months of the fiscal year. Despite a slight decrease in IT exports in November, which stood at $324 million indicating a 2pc drop compared to October, the overall economic outlook remains optimistic with a surplus of $729 million recorded for the month.

Read More: SBP slashes policy rate by 200 basis points

Earlier, the State Bank of Pakistan (SBP) slashed the policy rate by 200 basis points in its monetary policy announced on Monday.

“At its meeting today, the Monetary Policy Committee (MPC) decided to cut the policy rate by 200 bps to 13 percent, effective from December 17, 2024,” the SBP said in a statement.

It added that the inflation declined to 4.9 percent on a year-to-year basis in November 2024, in line with the ‘MPC’s expectations’.

“This deceleration was mainly driven by the continued decline in food inflation as well as the phasing out of the impact of the hike in gas tariffs in November 2023. However, the committee noted that core inflation, at 9.7 percent, is proving to be sticky, whereas inflation expectations of consumers and businesses remain volatile,“ the SBP added.

In October 2024, Pakistan recorded a current account surplus of $349 million, with exports and remittances showing an upward trend. The central bank’s foreign exchange reserves now stand at $12.05 billion, contributing to a total national reserve exceeding $16 billion.

Financial Advisor Khurram Shehzad described the rate cut as a positive move for the economy, stating that lower interest rates encourage investment and reduce inflationary pressures. He noted that further rate cuts could be considered if inflation remains within the 5 percent to 7 percent range.

Trader leader Zubair Motiwala also expressed gratitude for the reduction, calling for the interest rate to be brought down to single digits by January to further boost the economy.

Meanwhile, Prime Minister Shehbaz Sharif commended the State Bank for the rate cut, calling it a promising step for the nation’s economy. He highlighted the benefits of reduced inflation, increased investor confidence, and greater economic activity.

The Prime Minister expressed hope for further inflation relief in the coming months and praised the efforts of the Finance Ministry and other related departments in achieving this progress.